Why retailers are losing sales — and what you can do about it

30 April 2025

Author:

When businesses think about availability issues and lost sales, the natural instinct is to blame either supply problems (getting stock to the depot) or store execution failures.

But according to our analysis of Retailer X, there’s another hidden cause — one that could be silently eating away at performance every day.

The hidden 20%: not depot, not store — the ‘in-between’ problem

In the video below, Gordon Neil, Thumbprint Managing Director, explains that around 20% of availability issues are not caused by supplier delays or in-store execution, but by failures in moving stock from depot to store efficiently – a challenge we’ve seen across the grocery channel specifically.

In his words:

“Retailers are running stock so close to zero that they close the day out of stock — meaning they start the next day with an availability issue.”

This slow “drip” effect damages not just short-term sales but causes a gradual erosion of base volume over time, creating a compounding sales decline.

Store-level problems: 73% of lost sales are controllable

While depot and delivery logistics cause issues, store-level performance remains the biggest driver — accounting for over 73% of lost sales in Q1 2025 within the grocery sector, based on our field analysis of Retailer X (source: DART analysis).

Breaking it down:

- Only 20% of store-related issues are due to unfixable problems like staffing.

- A big 12% chunk stems from book stock errors — mistakes in recorded stock levels that can be corrected centrally or with better field interventions.

Correcting book stock isn’t dependent on in-store staffing — it’s a data and process fix that can be addressed centrally.

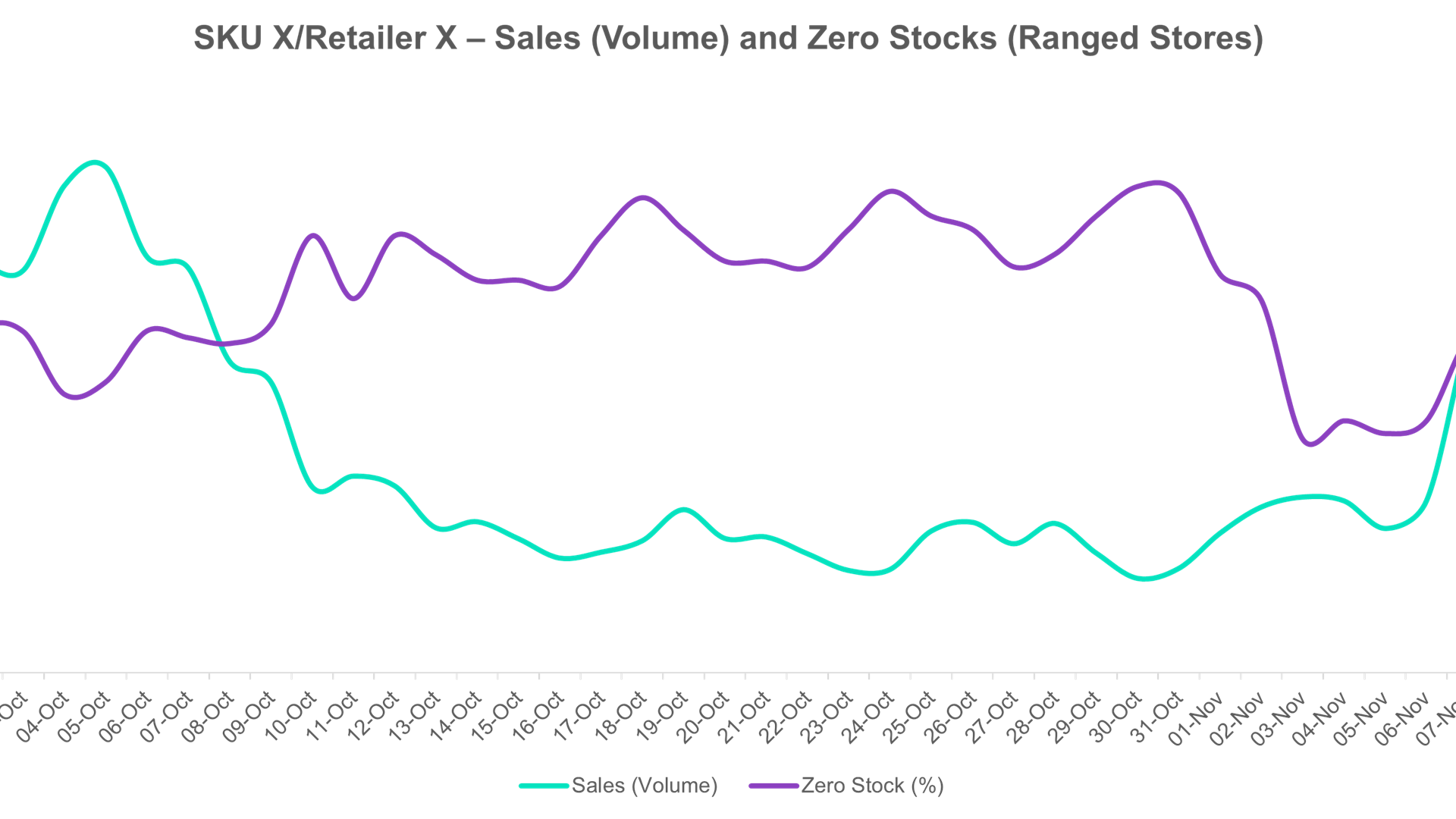

Data-backed evidence: zero stock = sales decline

Analysis of Retailer X’s Q1 2025 data shows:

- A clear correlation between increasing zero stocks and declining sales, especially during promotional periods.

- In the final weeks of promotions, stores see lower stock levels and faster sales drop-offs.

October and November are particularly noticeable for this trend.

Simply put, more zero stock closures = faster sales declines.

What can brands do about this?

The path forward for future brand success is clear:

- Identify and track zero stock closures

- Fix book stock errors centrally where possible.

- Work closely with retailers to optimise depot-to-store flows — especially on long shelf-life products (where wastage risks are low).

As Gordon puts it:

“Long shelf-life products should never close the day at zero stock — there’s no excuse.”

Brands have control over a significant part of availability issues — they just need the right data and the right conversations.

Watch the video with Gordon below.

For more Insights like this, follow us on Linkedin