Thumbprint Insight: The impact of new legislation in the alcohol sector in Convenience

17 December 2024

Author:

This month’s insight comes from the Convenience sector with exclusive data insights from our platform Pinpoint. Our Thumbprint Managing Director, Gordon Neil discusses which alcohol categories have been impacted by the new minimum unit pricing and what sales performance looks like in the sector as a result.

We explore the impact of new legislation, which is impacting many more categories across the FMCG trade – but just how is the recent change in minimum use unit pricing in Scotland impacting the alcohol sector overall? Here’s what our data tells us…

If we start by looking at the average price of beer and cider, we can see that since the new increase in minimum unit pricing took effect in Scotland, there’s been a 2% rise. This is equivalent to six pence per litre in the average price of beer and cider. However, it’s relatively static across the rest of the UK where the legislation isn’t in place.

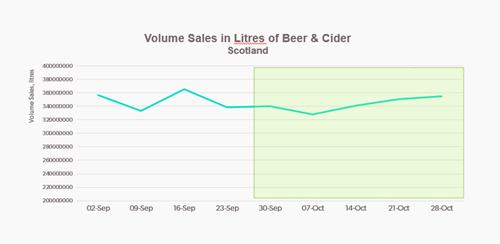

Beer & Cider

When we look at what impact this has had, Pinpoint highlights a slight reduction in the weekly volume of beer and cider with 0.91%. Although it's over a very short period of time, it will be interesting to see how that impact continues as we go into the Christmas period and 2025.

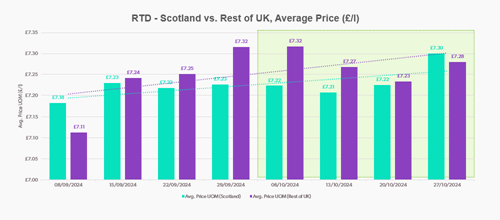

Ready to drink

Next, we can turn our attention to the Ready to Drink (RTD) category. Pinpoint data shows that pricing here has remained relatively flat. However, what we can see is that the pricing of RTDs is probably one of the most volatile in the alcohol category week to week. There has been a slight increase of an average of two pence over the course of the four weeks after the minimum unit pricing took effect.

Wine

Turning to wine, this remained relatively the same. However, we can chart the scale of difference in the average price per litre in wine in Scotland versus the rest of the UK, although overall prices remain broadly the same.

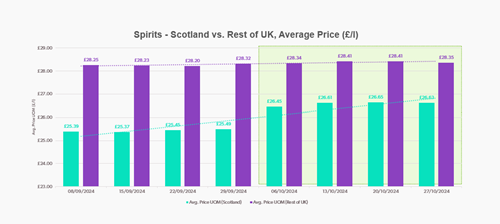

Spirits

Lastly, looking at the spirits category, Pinpoint highlights an interesting trend here with the average price per litre actually higher in the rest of the UK than it is in Scotland. Remarkably, since the minimum unit pricing increase took effect, we have seen an increase in the average 1:54 price per litre of 4.6%, which is the equivalent of £1.16 per litre.

So, what's the reason for the difference in the average price per litre in the rest of the UK versus Scotland? It’s because Scottish shoppers purchase a different combination of spirits versus the rest of the UK, and you can see particularly the impact of Glen's Vodka, which is one of the top three purchased products in Scotland versus the rest of the UK. It actually equates for almost 32% of all spirits sales between the 2nd of September and the 3rd of November, and that product has a much lower price per litre than the rest of the category at £24.29. This is the reason why the price per litre might be lower in Scotland than it is in the rest of the UK, despite these products still being impacted by the minimum unit price increase.

When we turn our attention to what the impact of the legislation is on overall spirit sales in Scotland, we can see is it's had no real effect. Data shows that towards the last couple of weeks of October, you can actually see a slight increase in sales in spirits.

Again, it will be interesting to see the further impact this has over the busy Christmas and new period into 2025.

We publish regular insights videos like this one on our LinkedIn page so please follow us to stay up to date: https://vimeo.com/1040039402?share=copy

Join us next month where we'll be talking about Christmas performance across retail. If you want to keep up to date with all of our latest insight you can follow us on LinkedIn.

To unlock insight into your brand’s category, talk to our team.